For many years HMRC have penalised business for late VAT submissions using a penalty regime known as ‘default surcharge’. The purpose of this notice is not to redress old legislation but to make you aware of changes coming in 2023.

Under the new penalty process you can be fined for the late submission of your VAT return (even if you are in a repayment position), fined for a late payment of any VAT due on your return or, in some instances, both.

Penalties for late submission of VAT returns

The changes will apply to VAT for all accounting periods beginning on or after 1 January 2023 .

How the system works

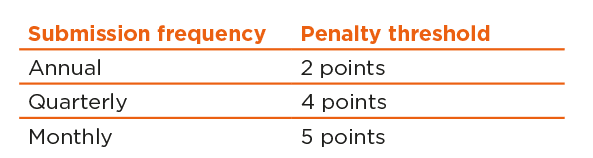

Taxpayers will receive a point every time they miss a submission deadline. HMRC will notify them of each point. At a certain threshold of points, a financial penalty of £200 will be charged

The penalty thresholds will be as follows:

To prevent financial penalties caused by historic failures being added to occasional recent failures, points will have a lifetime of 2 years; after which they will expire.

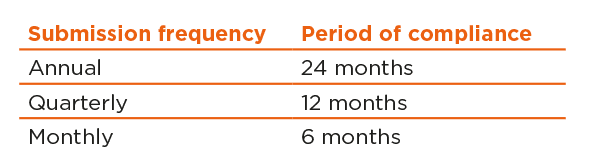

After a taxpayer has reached the penalty threshold, all the points accrued will be reset to zero when the taxpayer has met both the following conditions:  Time limits

Time limits

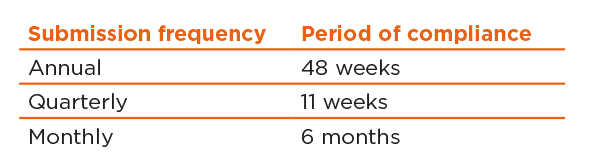

There will be time limits after which a point cannot be levied.

The time limits for levying a point depends on the taxpayer’s submission frequency and start from the day on which the failure occurred, as follows:

The time limit for HMRC to assess a financial penalty will be 2 years after the failure which gave rise to the penalty.

Where HMRC discovers that a taxpayer had previous submission obligations which HMRC was unaware of at the time, HMRC will also have 12 months from the date of the discovery to levy points and financial penalties.

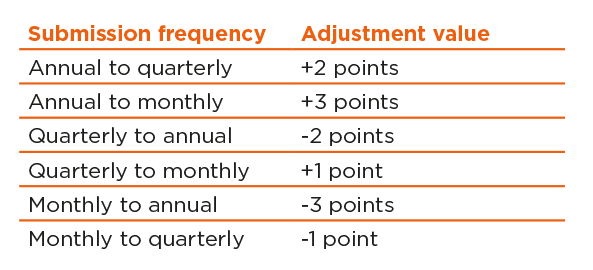

Changing frequency

If a business changes the frequency of their returns, for example monthly to quarterly, there will be an adjustment to the number of points a taxpayer has been allocated.

Groups

Groups

Where a VAT group has incurred penalty points and the representative member of that group is replaced, the new member will be treated as having the same number of penalty points as the previous member.

Where a VAT group has incurred penalty points and a new group member joins, the penalty points for that group will continue unchanged.

Non-standard tax periods

In some taxes taxpayers can ask if they can provide submissions for non-standard accounting periods. Where such periods are transitional, they will be excluded from submission obligations considered as part of the new points-based penalty regime.

Penalties & Interest for late VAT payments

The penalties will apply to all late VAT payments for accounting periods beginning on or after 1 January 2023. It will harmonise VAT interest charges and repayment interest in line with other tax regimes.

Penalties

There are two late payment penalties that may apply.

First penalty

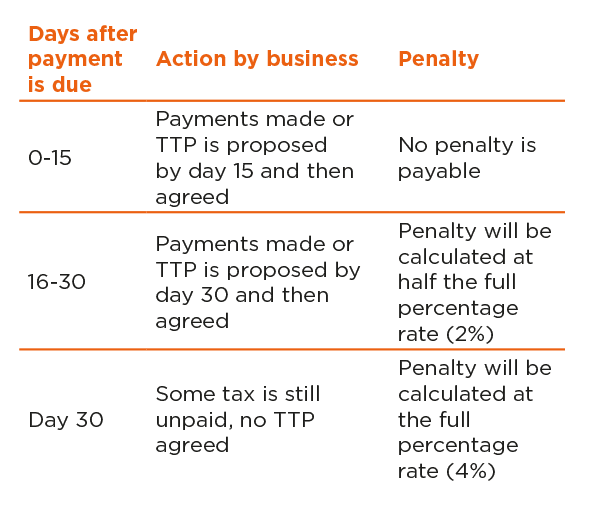

- The taxpayer will not incur a penalty if the outstanding tax is paid up to 15 days after the due date.

- If tax remains unpaid after day 15, the taxpayer incurs the first penalty.

- This penalty is set at 2% of the debt which remains outstanding after day 15.

Additional or second penalty

- If any of this tax is still unpaid after day 30, the penalty will be calculated at 4% interest.

- It accrues daily at a rate of 4% per annum on the outstanding debt. This additional penalty will stop accruing when the taxpayer pays the tax that is due.

Time-to-Pay arrangements

HMRC will offer taxpayers the option of requesting a Time-to-Pay (TTP) arrangement. If a TTP is agreed no further penalties will be incurred.

Penalty waiver or reduction

Penalty waiver or reduction

HMRC has discretionary power not to charge or reduce a penalty for late payment.

It also states that it recognises that moving to the new system of late payment penalties is a significant change, especially for those who might have more difficulty in getting in contact with HMRC within 15 days of missing a payment to begin agreeing TTP. HMRC will therefore take a light-touch approach to the initial 2% late payment penalty for customers in the first year of operation.

Where a taxpayer is doing their best to comply, HMRC will not assess the first penalty at 2% after 15 days, allowing taxpayers 30 days to approach HMRC in the first year the new rules come into operation. However, if a taxpayer has not approached HMRC by the end of day 30 and there is still an amount of tax outstanding, the first penalty will be charged at 2% and the amount outstanding at day 30 will attract a 4% penalty.

Interest

HMRC will charge late payment interest on tax that is outstanding after the due date, irrespective of whether any late payment penalties have also been charged. The late payment interest will apply from the date the payment was due until the date on which it is received by HMRC.

Late payment interest will be calculated at a rate of 2.5% plus the Bank of England base rate.

Where a taxpayer has overpaid tax, HMRC will pay Repayment Interest (RPI) on any tax due back to the taxpayer either from the last day the payment was due to be received or the day it was received (whichever is later) until the date of repayment.

RPI will be paid at the Bank of England base rate less 1% (with a minimum rate of 0.5%).

Late payment interest will continue to accrue on amounts not paid on time even if those amounts are included in a TTP arrangement.

Need help?

Please contact us if you are unsure if you would like further information on any of the points raised above.