The announcement of the Super Deduction in the Spring Budget was an unexpected ‘tax giveaway’ by the Chancellor, and one welcomed by many businesses.

Broadly, the Super Deduction provides for an enhanced 130% capital allowance on new qualifying main pool (“MP”) plant or machinery expenditure, or 50% on special rate pool expenditure (“SRP”), incurred between 1 April 2021 to 31 March 2023. To qualify for the deduction the asset must be purchased (or the agreement to purchase the asset signed) after 1 April 2021.

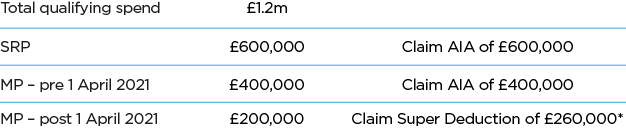

This is a separate relief to the Annual Investment Allowance (currently £1m per annum to 31 Dec 2021), and can be claimed alongside this, which can give companies flexibility to maximise the tax relief available over this qualifying period.

For example:

* assuming the qualifying conditions are met.

It is worth noting that if any assets on which the Super Deduction is claimed are later sold, this leads to a balancing charge. Given that the corporation tax headline rate is due to increase to 25% from 1 April 2023, this should be taken into account when deciding which allowances to claim.

Leasing companies

There was initially disappointment for property rental businesses, as most of their assets seemed to be excluded from the Super Deduction under the capital allowances legislation as they are deemed to be held for leasing . However, a last minute change to the rules allows a business to claim the super deduction on background plant and machinery in a leased building. Background plant and machinery is defined as any plant or machinery:

(a) which is of such a description that plant or machinery of that description might reasonably be expected to be installed in, or in or on the sites of, a variety of buildings of different descriptions, and

(b) whose sole or main purpose is to contribute to the functionality of the building or its site as an environment within which activities can be carried on.

Similarly, businesses that purely lease plant and machinery to their customers with no other services provided with the equipment will not qualify for the Super Deduction on these assets under this same leasing exclusion.

Pitfalls – Intra-group leasing

One common business structure that is likely to be impacted by this general exclusion is where a group of companies includes an asset owning company, and a trading business, and the asset company leases the assets to the trading business.

A common example of this is in the building industry, where high value plant, such as cranes, diggers etc. may be held separately from the trading business to minimise risk and protect the asset base of the group.

In these circumstances, the equipment purchased by the asset owning company in the qualifying period will not qualify for the Super Deduction as a result of the leasing exclusion, as there are no specific reliefs for leasing to group or connected entities.

In these types of structures, it is worth considering whether to acquire any qualifying assets in the trading business during this 2-year window, to maximise the availability of the Super Deduction within the group.

A business will need to weigh up the additional 30% tax deduction against the commercial risk and perhaps the financing impact of a temporary change in how the group operates.

Accounting periods straddling 1 April 2023

The rate of the super-deduction will require apportioning if an accounting period straddles 1 April 2023. The rate should be apportioned based on days falling prior to 1 April 2023 over the total days in the accounting period. This means that the benefit will start to fall away from1 April 2022.

If you operate a business structure as described above and want to discuss the availability of the Super Deduction or any other capital allowances matters, our business tax team would be happy to have a chat with you. You can contact us via the website, or speak to your usual PEM contact.

Please note that this article is not intended to give specific technical advice and it should not be construed as doing so. It is designed merely to alert clients to some issues. It is not intended to give exhaustive coverage of the topics. Professional advice should always be sought before action is either taken or refrained from as a result of information contained herein. The firm’s full name and a full list of Partners is available here.