We are now in a new tax era for buy-to-let investors. With many changes set in stone (and there’s more to come), landlords need to take a thorough look at current portfolios and think carefully about potential future investments.

Tax squeeze on finance costs

A number of residential landlords have felt the pain of increased tax bills in January 2019 as it’s no longer possible to deduct the full amount of the finance costs when calculating their taxable rental profits. Instead, tax relief is increasingly being given as a 20% reduction in their tax rather than as a deduction against rents; from 6 April 2020, this tax credit will be the only way of getting any tax relief on such costs.

Landlords letting commercial property and qualifying furnished holiday accommodation are not affected by the restrictions.

Those with large residential property portfolios and high borrowings are being hit the most and we expect effective tax rates in the order of 160% for some landlords from 2020. Many basic rate taxpayers are being affected by the changes despite the headline 20% relief.

Additionally, some landlords will be forced to pay tax when they have made a financial loss, perhaps due to difficulties in finding a tenant or as a result of facing unexpected repair bills.

To make matters worse, the automatic right for landlords of furnished property to claim a 10% wear and tear allowance has been scrapped. They are now only be able to get tax relief on what they spend on qualifying expenditure.

HMRC have also begun to challenge claims for tax relief on mortgages taken out to allow landlords to withdraw their equity in the business (e.g. the value of cash deposits put down on property purchases). In the past, if owners increased their mortgage to take their initial investment back from the business, it was believed that HMRC allowed relief on the extra interest no matter how the cash was used.

Limited company a solution?

Although the restrictions apply to individuals, partnerships and trusts, company landlords are not affected and this offers a potential solution.

Some landlords who run their property portfolio like an ordinary commercial business have an opportunity to transfer their properties to a limited company free of significant tax charges. Capital gains can be rolled over on incorporation and the company may not be liable for any Stamp Duty Land Tax if the business is currently operated as a partnership (which can exist without being formally registered with HMRC).

Each case is fact specific and it is important to take specialist tax, legal and financial advice at an early stage, as establishing the status of the business, dealing with the incorporation process and refinancing is not straightforward.

Company profits are taxed at corporation tax rates (currently 19%, but reducing to 17% from April 2020) rather than much higher income tax rates, leaving more funds to grow the property portfolio and/or provide a route to an early mortgage repayment. Additionally, companies can be structured to save future inheritance tax.

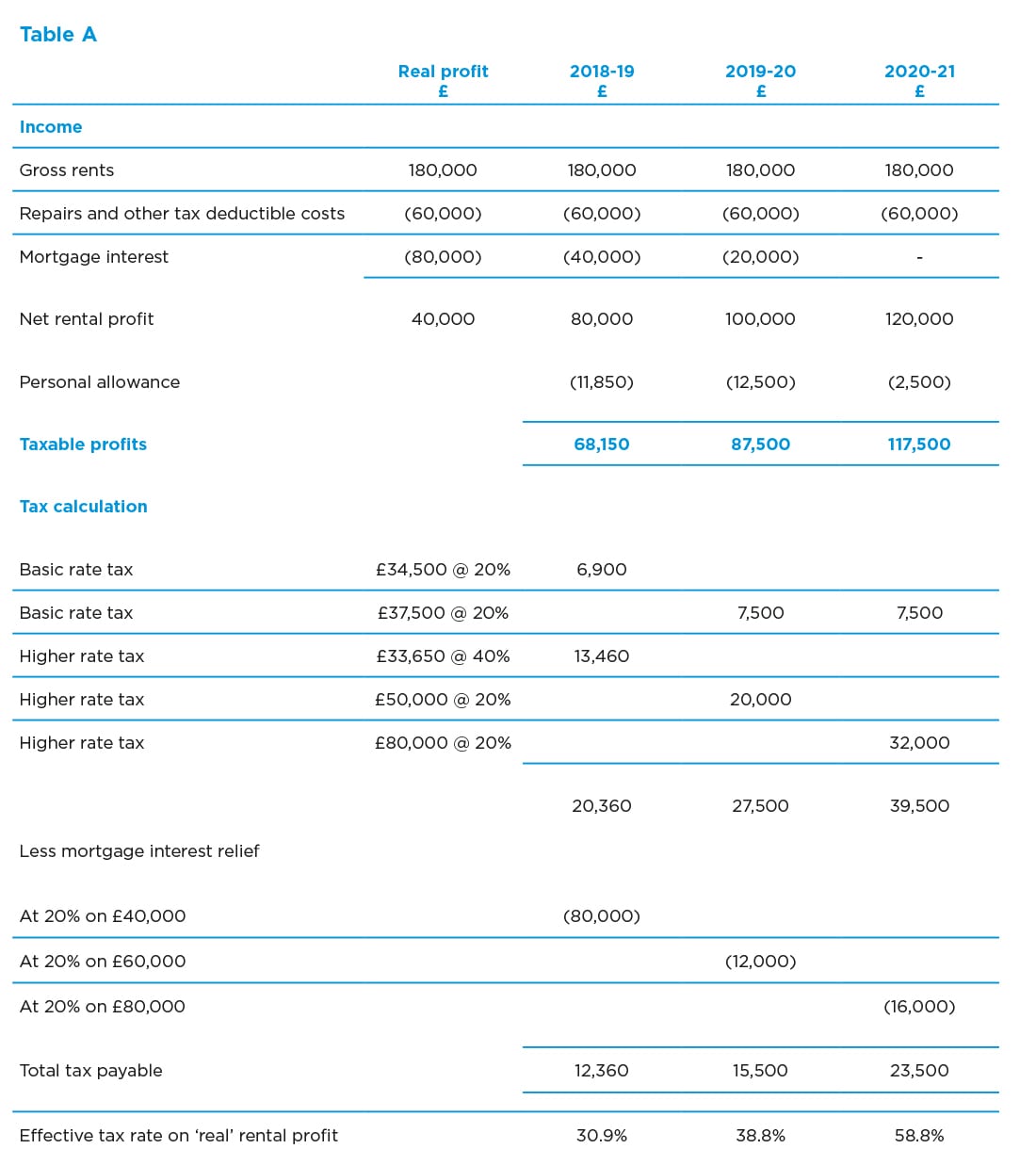

Let’s take a closer look at the effect of the changes on a basic rate taxpayer (assuming he/she has no other income).

Table A

2016-17 was the last tax year in which the mortgage interest of £80,000 was deductible in full in arriving at the real rental profits of £40,000 (£29,000 taxable at 20% after deducting the personal allowance).

In 2017-18 the impact of the reducing amount of allowable mortgage interest was felt for the first time, where 75% was deductible with the remaining 25% enjoying a 20% tax credit.

In 2018-19 the proportions are 50% each, resulting in an effective tax rate of 30.9%.

In 2019-20 only 25% of the mortgage interest is deductible against the rental income, with 75% being given as a 20% tax credit; the increases the effective tax rate to 38.8%.

From 2020-21 the impact of the new rules will be fully felt, resulting in an effective tax rate of 58.8%. The effect is to push income into the higher rate tax bracket which leads to a withdrawal of the personal allowance to £2,500 as income exceeds £100,000.

Additionally, any child benefit received is clawed back completely once taxable income hits £60,000.

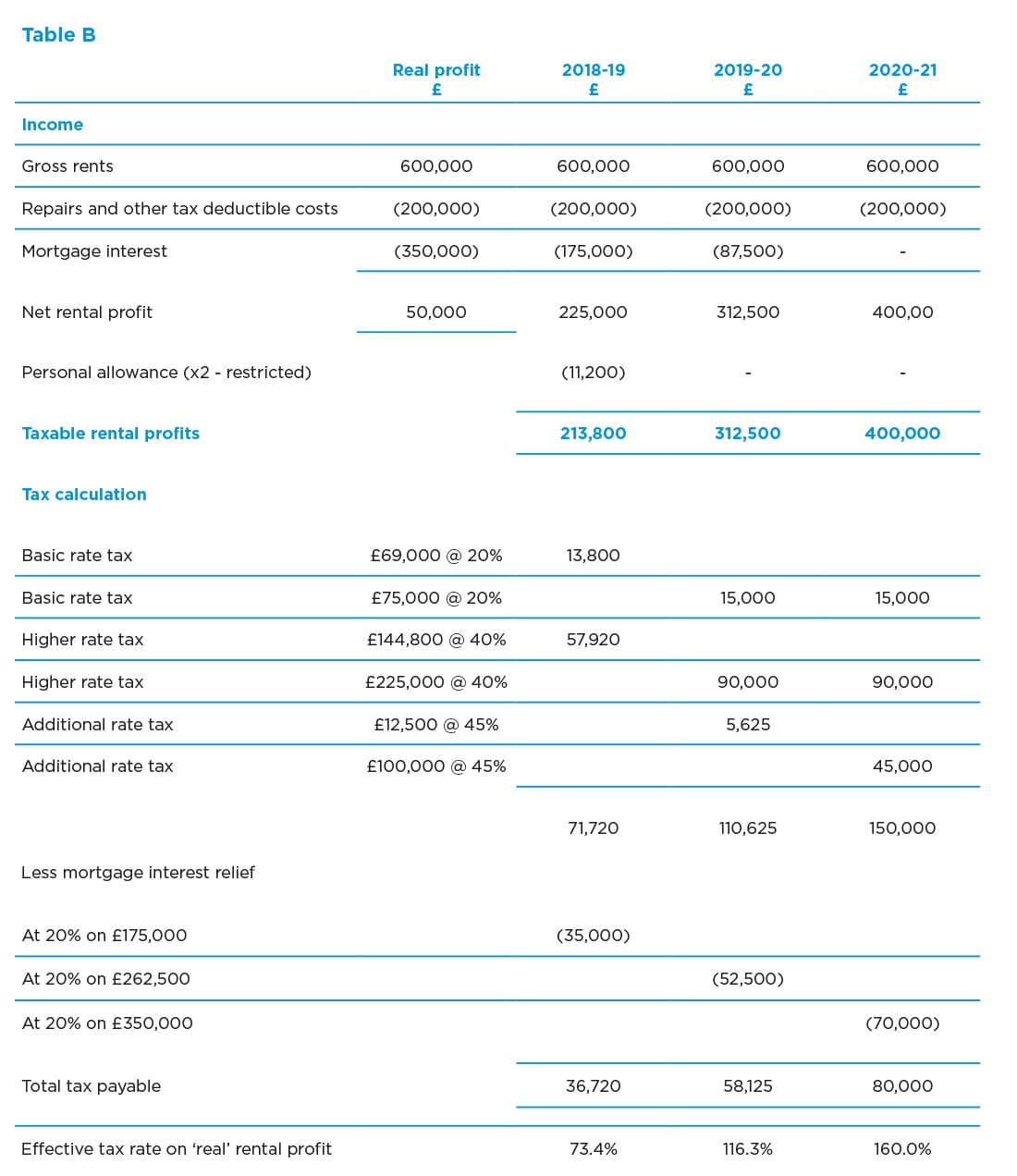

For larger property portfolios with high borrowings, the position is even more dramatic. Consider the following property business run by a married couple in partnership (again assuming no other income).

Table B

From 2020-21, the tax charge of £80,000 applies which equates to 160% of the ‘real’ rental profit of £50,000. This is clearly not viable.

Whatever your situation, now is the time to do the maths and weigh up the options before the restrictions fully bite.

Other taxes to think about

Investors hoping to build their portfolios also face a 3% surcharge on Stamp Duty Land Tax on properties bought for rental or as a second home. There is also an additional 2% surcharge for non-UK residents purchasing residential property, which applied from 1 April 2021.

From 1 March 2019, the Stamp Duty Land Tax payment window reduced from 30 to 14 days.

From April 2015, the profit on sale of UK residential property by non-residents has been subject to UK Capital Gains Tax (this is to be extended to commercial property from April 2019). A non-resident Capital Gains Tax return needs to be submitted to HMRC within 30 days of completion together with any Capital Gains Tax (unless the taxpayer is within self-assessment where the normal due dates apply). Late filing penalties apply.

From April 2020, all disposals of UK residential property will need to be reported within 30 days and any Capital Gains Tax is payable by the filing date. This change will catch residents as well as non-residents.

Companies (or partnerships with a corporate member) holding any high value dwellings which are individually worth more than £500,000 (on 1 April 2017 or when acquired if later) are under an obligation to file an Annual Tax on Enveloped Dwellings (“ATED”) return. Returns must be filed and any tax must be paid by 30 days after the start of the ATED year, which runs from 1 April to 31 March. If a company first falls within ATED during the year then the return and tax are due within 30 days of entering the regime. Most landlords do not have to pay the tax as there is a relief for property letting which is conducted on a commercial basis, but this relief must be claimed by submitting a return. Late filing penalties apply. Use of the dwellings by individuals connected with the company can lead to the relief being lost, either partially or fully.

High value dwellings acquired by companies can also be subject to a flat rate of 15% Stamp Duty Land Tax in certain circumstances, which can apply retrospectively where there is non-qualifying use within 3 years. There is currently a proposal to increase the rate to 16% for non UK resident companies.