As part of the Budget, the Chancellor confirmed an extension to the Self-Employment Income Support Scheme. This reflects the Government’s ongoing efforts to provide fiscal aid to those affected by COVID-19.

Set out below are the main points of these extra Self-Employment Income Support Scheme payments:

Fourth Grant

The next grant will be for February, March, and April 2021. Like the earlier grants, you must either:

- Be trading but are being impacted by the pandemic; or

- Are temporarily unable to trade due to COVID-19.

In addition, HMRC will require you to confirm the following:

- You still intend to trade; and

- You believe there is significant reduction in your profits because of the coronavirus.

If you started trading after 6 April 2019, you will be able to claim this grant payment. This is because the payment will be based upon your 2019/20 tax return. However, this return must have been filed before midnight on 2 March 2021.

To be eligible for the grant, your trading profit must be no more than £50,000 and at least equal to your non-business income. Even if you do not qualify for this grant based upon your 2019/20 figures, HMRC will review your position based upon the previous four tax years.

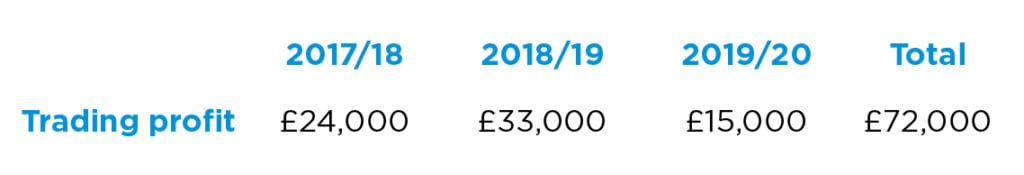

As before, this grant will be calculated at 80% of the three months’ average trading profits but capped at £7,500. This is based upon your average profits over the last three years.

Here is an example of how the grant payment is calculated:

Average trading profit across the 3 tax years is £24,000.

This equates to £2,000 per month and, hence, the three month’s average trading profits will be £6,000.

Based upon this figure, the grant will be 80% of £6,000, being £4,800.

It should be noted that if you have traded for less than 3 years, the calculation will be based upon the relevant number of tax years.

You will be able to start applying for this payment from late April 2021. Your claim will need to be made by 31 May 2021 at the latest.

Fifth & final grant

There will also be a fifth and final grant covering May to July.

Unlike the past grants, this payment will be based upon the actual decrease in the amount of income taken by your business during the year to April 2021. This income is commonly referred to as the business’s turnover.

The fifth grant payment will be worth:

- 80% of the three month’s average trading profits, capped at £7,500. This is for cases where the reduction in turnover is 30% or more; or

- 30% of three month’s average trading profits, capped at £2,850 for cases where the turnover reduction is less than 30%.

The basis for the three month’s average trading profits will be same as for the fourth grant.

Also, HMRC have not yet confirmed the basis on which this turnover reduction will be assessed.

Claims for this final payment are likely to be from late July.

If you want to check if you are entitled to these grants or want to know how much these payments may be, please contact us. We will be happy to review your position and chat through your options before you make the SEISS applications.